In the U.S., there's a saying: “Common sense isn’t so common.” That seems to perfectly describe Dean Metropoulos, the Greek-American businessman who, alongside One Rock Capital Partners, pulled off the $4.3 billion acquisition of Nestlé Waters North America—a move many are calling a golden deal.

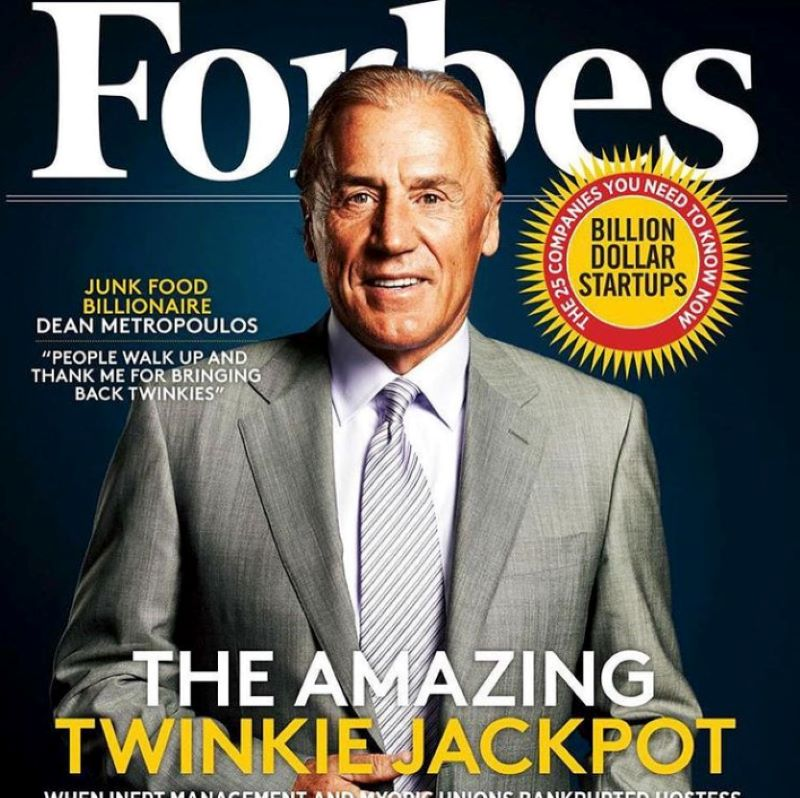

Nestlé Waters North America operates in the U.S. and Canada and has been part of the world’s largest bottled water company since 2008. Following the acquisition's finalization, expected this spring, 74-year-old Metropoulos will serve as the company’s Chairman and interim CEO. Not bad for someone who started out in a poor village in Arcadia, Greece—and eventually made the cover of Forbes as one of the world’s billionaires.

A Self-Made Empire

Dean Metropoulos is the epitome of a self-made man. Forbes ranks him an 8 out of 10 in its self-made score. His vast fortune—estimated at $2.7 billion—comes primarily from investments. As the chairman and CEO of C. Dean Metropoulos & Co., he manages a portfolio that includes bonds, real estate, stocks, and stakes in billion-dollar companies.

Metropoulos ranks #339 on the Forbes 400 Richest Americans list and #875 on the list of global billionaires for 2020. But his success story isn’t just about wealth—it’s also about giving back. He serves as a trustee of the National Hellenic Museum in Chicago and received the IFG (International Foundation for Greece) award for entrepreneurship in 2019. To honor him, the Hellenic Post even issued a commemorative stamp series titled Distinguished Greek Personalities.

From Arcadia to Wall Street

Charles Dean Metropoulos was born in 1946 in the small Arcadian village of Chranous, and emigrated to Boston at the age of 10. He studied business on a scholarship at Babson College, the only college in the U.S. focused exclusively on entrepreneurship, where he earned both his Bachelor’s (1967) and Master’s (1968) degrees. He later pursued further studies at Columbia University and by the age of 25, was working in Geneva as the financial director of GTE Corporation (later Verizon).

By 32, he had become the company’s youngest CEO, and soon after, launched Dean Metropoulos & Co. His first acquisition? A cheese company in Vermont—his wife’s home state.

Over the next four decades, Metropoulos would go on to acquire more than 80 companies, earning the title “King of Acquisitions.”

The “Dead” Brands Whisperer

His business strategy? Reviving forgotten or failing brands and turning them into goldmines. Among his acquisitions were:

Pinnacle Foods

Ghirardelli Chocolate Company

International Home Foods

Pabst Brewing Company (until 2014)

The Morning Star Group (later sold to Suiza Foods, which became Dean Foods)

Mumm’s/Perrier–Jouët Champagne

Solar Marine, an international dry cargo shipping company

One of his most pivotal moves was founding International Home Foods in 1996, growing it, and selling it just four years later for $2.9 billion.

The Playboy Mansion & Family Legacy

Today, Metropoulos resides in Palm Beach, Florida, with his wife Marianne, who previously ran the Beverly Hills-based Aegean Entertainment production company and contributed $17,500 to Joe Biden’s 2020 presidential campaign. Their son, Daren Metropoulos, made headlines in 2016 for purchasing the iconic Playboy Mansion for $100 million, saying his interest was less about its fame and more about preserving its architectural legacy. One condition of the sale? Hugh Hefner could live there for the rest of his life.

Dean credits his sons, Daren and Evan, with playing key roles in his billion-dollar deals, helping breathe new life into stagnant brands with fresh thinking and modern marketing.

Twinkies, Tuna, and the Revival Machine

Some of the iconic American brands Metropoulos helped resurrect include:

Twinkies (via Hostess)

Chef Boyardee canned pasta

Bumble Bee Tuna

Each of these was revived under his company and later resold—often at a profit.

His Next Challenge: Bottled Water

Metropoulos’ latest venture with Nestlé Waters North America comes with its own hurdles. According to Bloomberg Intelligence analyst Duncan Fox, private-label bottled waters hold a large U.S. market share, but the COVID-19 pandemic severely hit sales, especially in restaurants and tourist destinations. Furthermore, pricing is largely out of Nestlé’s control—which might be why the company decided to offload the division.

In parallel, sustainability pressures are mounting. Giants like Coca-Cola and PepsiCo are investing heavily in eco-friendly packaging, including for their water products. Whether Metropoulos can revive this segment remains to be seen.

But if history is any guide, few are better suited to the task. “One thing I’ve learned,” Metropoulos once said in an interview, “is that I’m very disciplined and faithful to the classical structures of entrepreneurship. I can take a business opportunity and lead it effectively in a traditional, structured way. That doesn’t mean we aren’t competitive—we just find unique angles to present our work.”